Understanding WPC Share Price ASX: A Comprehensive Guide

Get a detailed understanding of WPC’s stock on the ASX. This guide will help you navigate through the complexities of the market and make informed decisions.

Understanding WPC Share Price ASX: A Comprehensive Guide

Introduction

The Westpac Banking Corporation (WBC) is one of Australia’s largest banks, and its stock price, listed on the Australian Securities Exchange (ASX) under the ticker WPC, is closely watched by investors. Understanding factors that influence WPC’s share price is essential for anyone looking to invest in or analyze this significant player in the financial sector. This guide will provide a comprehensive overview of what affects WPC’s share price on the ASX, covering topics like company performance, industry trends, economic conditions, and investor sentiment.

Company Performance

One of the primary drivers of WPC’s share price is the company’s overall performance. Financial reports, such as quarterly earnings, are critical indicators of the bank’s health. Positive earnings, strong balance sheets, and consistent dividend payouts can drive the stock price up. Conversely, poor financial results, regulatory issues, or unexpected losses can lead to a decline in the share price. Investors often scrutinize these reports for insights into the bank’s management strategies and future prospects.

Industry Trends

The banking sector as a whole plays a crucial role in shaping WPC’s share price. Factors such as interest rate changes, regulatory reforms, technological advancements, and competition from fintech companies can all impact the bank’s operations and profitability. For instance, if the Reserve Bank of Australia (RBA) decides to increase interest rates, it could positively affect the bank’s margins, leading to an increase in the share price. However, if there is increased competition from fintech startups offering innovative services, it might put pressure on traditional banking models and potentially lower the share price.

Reserve Bank of Australia Cash Rate Target

Economic Conditions

Macroeconomic factors also significantly influence WPC’s share price. Economic growth, inflation rates, unemployment levels, and global economic conditions all play a role in determining the overall health of the banking sector. During periods of economic downturn, consumer confidence may decrease, leading to reduced lending activities and higher non-performing loans, which can negatively impact the bank’s financial performance and share price. On the other hand, during periods of economic expansion, increased lending activity can boost the bank’s profits and share price.

Australian Bureau of Statistics Macroeconomic Indicators

Investor Sentiment

Lastly, investor sentiment can heavily sway WPC’s share price. Investor perceptions about the bank’s future prospects, influenced by news reports, analyst opinions, and broader market trends, can cause short-term volatility in the share price. Positive news or optimistic analyst forecasts can lead to buying pressure, driving the share price up. Conversely, negative news or pessimistic forecasts can result in selling pressure, causing the share price to fall. Monitoring media coverage and analyst ratings can help investors gauge current investor sentiment towards WPC.

Conclusion

Understanding WPC’s share price on the ASX requires a holistic approach that considers multiple factors including company performance, industry trends, economic conditions, and investor sentiment. By staying informed about these elements, investors can make more informed decisions and better predict potential movements in the share price. As always, it’s advisable to consult with a financial advisor before making investment decisions.

Reference

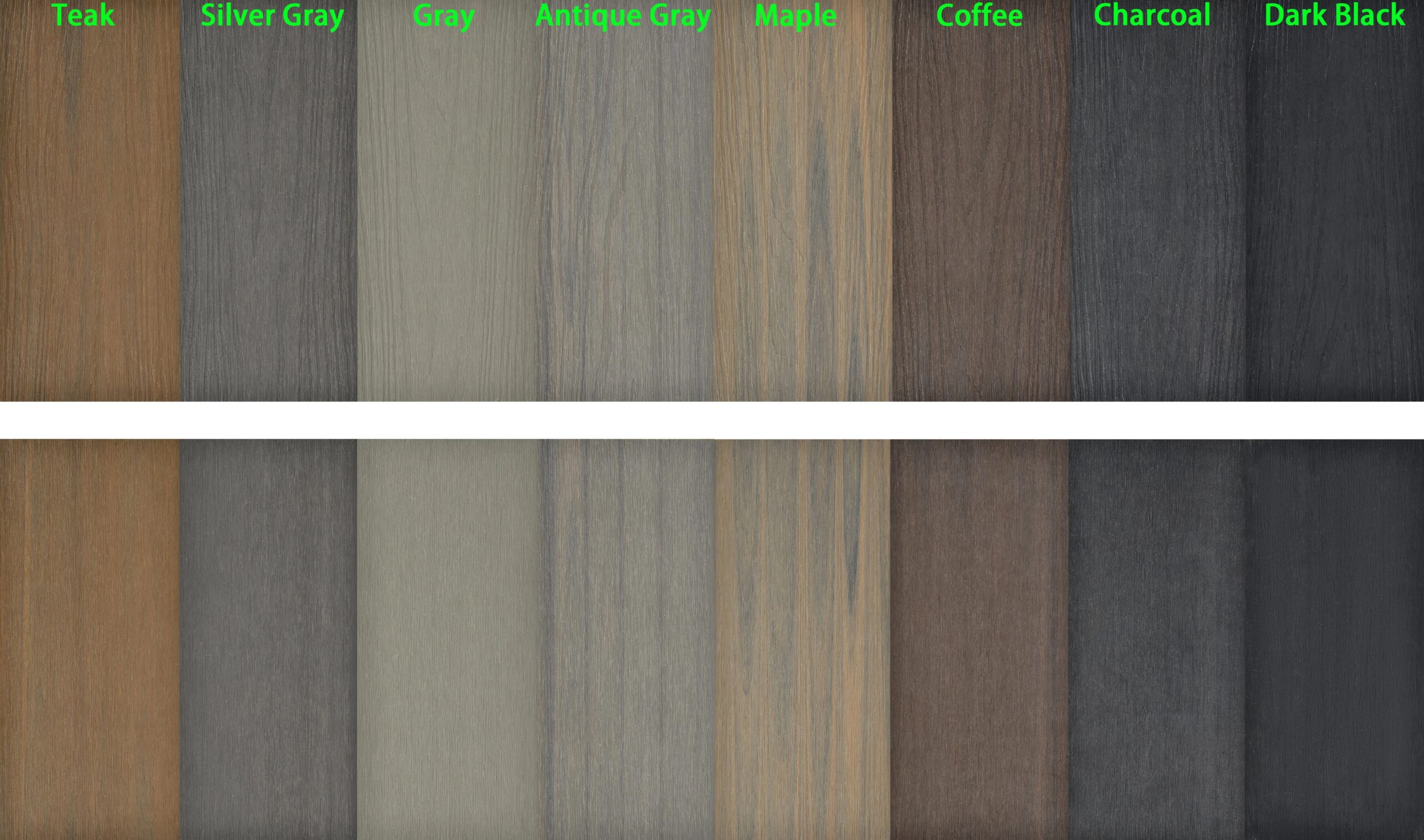

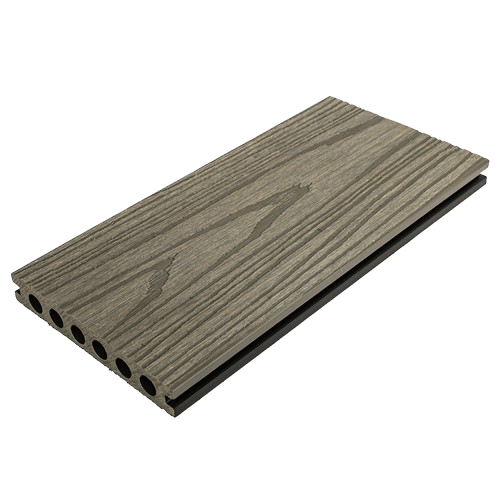

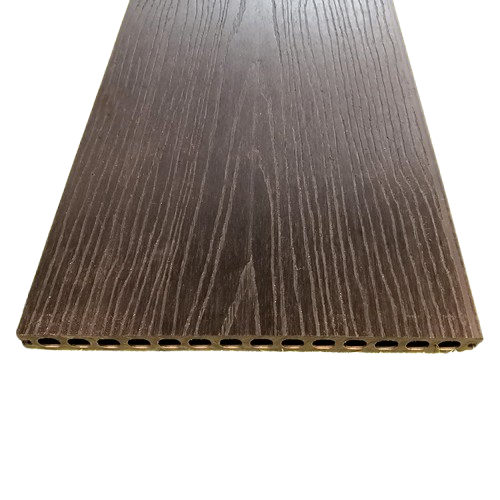

Baoding Plastroy WPC Products

Why Choose Plastory?

Baoding Plastory New Materials Co., Ltd. is a manufacturer of decorative materials with over 9 years of experience and 56 separate production lines.

Currently, our annual production exceeds 30,000 tons, with products exported to more than 50 countries worldwide.

Plastory is the drafting unit of the WPC National Standards and has obtained certifications such as REACH, ASTM, CE, and FSC. Plastory is dedicated to maintaining consistent quality, focusing on details, and prioritizing customer satisfaction.

Our factory is located in Baoding, Hebei Province, China, with a prime location and convenient transportation access. Baoding is approximately a 1.5-hour drive from Beijing Capital International Airport and just 2 hours away from Tianjin Port, making it easy for global clients to visit and facilitating efficient shipping of goods. Our facility spans a large area, equipped with advanced production equipment and modern testing facilities to ensure that every batch of products meets the highest quality standards.

We warmly welcome clients from around the world to visit our factory, where you can see our production processes firsthand and experience our product quality. Please feel free to reach out to us—we are committed to providing you with the best products and services.

Kindly get in touch with us to request a product catalogue.

Reviews

There are no reviews yet.